INFLATION AND PRICES

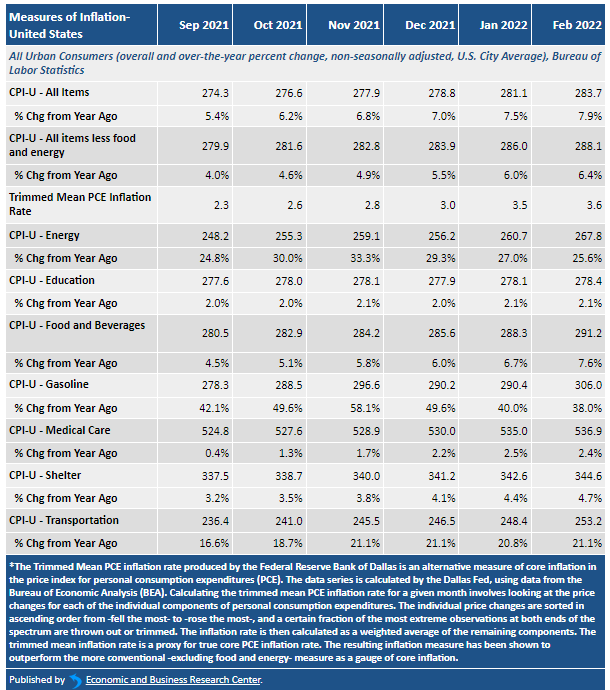

Inflation, as measured by the Consumer Price Index (CPI), reflects the annual percentage change in the cost to an average consumer of acquiring a standard market basket of goods and services. That is, inflation is not focused on a single product or sector, but rather measures the change in total expenditures a consumer faces to purchase essentially the same goods and services each month. The inflation rate is most often stated as an annual rate, for example, the inflation rate for April is the percent change in the CPI between April this year and April a year ago. The CPI is calculated by the Bureau of Labor Statistics. There are however, several “flavors” of CPI. The “inflation rate” we present here first is the standard rate most frequently cited in the news media. It is the year-over-year percent change in the Consumer Price Index for All Urban Consumers: All Items, U.S. City Average which is a measure of the average monthly change in the overall price for goods and services paid by urban consumers. Urban consumers include roughly 88 percent of the total population, accounting for wage earners, clerical workers, technical workers, self-employed, short-term workers, unemployed, retirees, and those not in the labor force.