HOUSING

Expand the Low-Income Housing Tax Credit program for renters, provide higher funding

limits for Section VIII vouchers, and mandate a portion of tax-increment financing (TIF) for

affordable housing.

• Support fair housing standards and anti-discrimination regulations.

• Eliminate public incentives for flipping houses.

• Promote and expand housing trust funds and non-profit programs to reduce evictions.

The cost of buying a home or renting an apartment has increased dramatically in many U.S. urban regions. As a result, buying a home has become out of reach for many and some renters have fallen behind on their payments.

And while the National Association of Realtors research found that the U.S. homeownership rate experienced its largest-ever annual increase in 2020, White families became homebuyers at much higher rates than racial minorities, especially Black families. Housing experts say the racial disparities are largely due to discriminatory policies and practices and systemic barriers that have prevented Black families from owning a home for decades.

NAIHC has been the lead agency for Pathways Home: A Native Guide to Homeownership training since 2004. The Pathways curriculum was developed specifically for Native Communities. This comprehensive train-the-trainer course instructs tribal housing and financial education professionals how to provide the course to prospective native homebuyers in their local communities. Those who complete the course earn a national certification as Homebuyer Education Instructors.

Social Housing For All: A Vision For Thriving Communities, Renter Power, and Racial Justice

To create a more equitable housing system, we must massively expand social housing: a public option for housing that is permanently affordable, protected from the private market, and publicly owned or under democratic community control. All levels of government must create public, non- profit means of housing finance, construction, management, and ownership to counter real estate speculation—rather than using our public funds to enrich for-profit speculators, private developers, and corporate landlords. Government policy should develop and maintain social housing by employing organized labor and creating union jobs. And we must ensure that systems of democratic accountability center low-income communities of color, renters, and the most marginalized residents in decision-making and control over resources. The implementation of social housing must redress inequity and exclusion; only through accountability to marginalized communities will social housing programs truly serve their interests.

NALCAB advances racial & economic equity by providing grants, loans and training to member organizations across the US — supporting their work to advance economic mobility in the Latino communities they serve.

NALCAB works to foster racial and economic equity by strengthening the ability of our member network to deploy capital where it’s needed most, and by influencing funders and policy makers with research, advocacy and technical advice.

Millions of Americans Have Used Risky Financing Arrangements to Buy Homes

Nationally representative survey finds disparities by race, ethnicity, and income in potentially harmful borrowing

What is alternative financing?

Typical alternative financing arrangements, such as land contracts, seller-financed mortgages, lease-purchase agreements, and personal property loans, differ from mortgages in important ways. For the purposes of this analysis, a mortgage is a real estate purchase credit agreement that typically involves a third-party lender who has no prior or other interest in the property separate from the loan and must comply with federal and state regulations. In mortgage transactions, title—that is, full legal ownership of the property as documented in a deed—transfers from seller to buyer at the same time the loan is initiated. By contrast, certain common alternative arrangements, for example land contracts, are not subject to significant regulations, and in purchases using these types of financing, the seller—and not the buyer as in a mortgage transaction—keeps the deed to the property for the duration of the financing term. And because many jurisdictions do not consider buyers to be homeowners if they do not officially hold title and have the deed in hand, this structure can create legal ambiguity and make it difficult for buyers to establish clear ownership or know with certainty who is responsible for property taxes and maintenance.

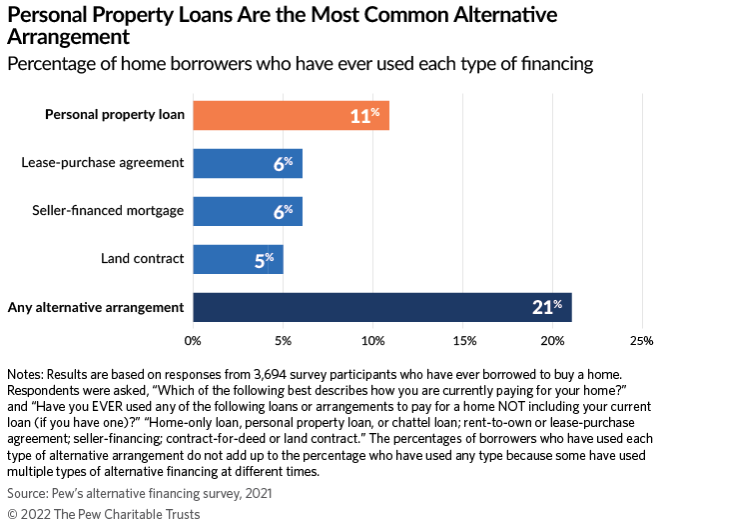

Approximately 1 in 5 home borrowers—about 36 million Americans—have used alternative financing at least once in their adult lives.

Of those, 22% have used more than one type of alternative arrangement across multiple home purchases, which suggests that some borrowers face repeated barriers to mortgage financing.

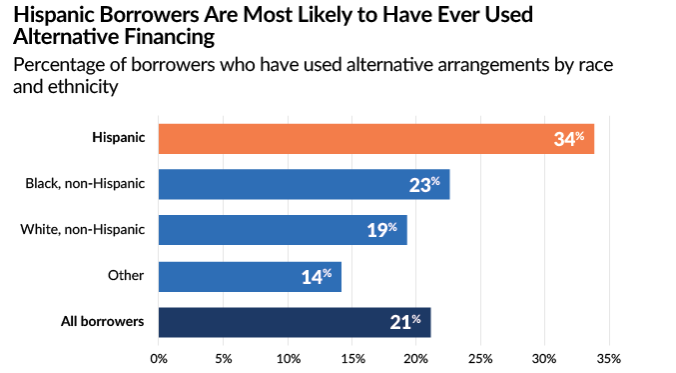

Use of alternative financing varied by race and ethnicity and was highest among Hispanic borrowers.

Roughly 1 in 15 current home borrowers—around 7 million U.S. adults—currently use alternative financing.

Among borrowers with active home financing debt, those with annual household incomes below $50,000 were more likely to use alternative financing.

And other factors related to a home’s habitability and the ownership of the land beneath a manufactured home—the modern version of a mobile home—can make certain homes ineligible for mortgage financing altogether